The updated Model Y Juniper sold 27,828 units in Europe in March, a 30% decline compared to the same month last year

- BEV sales in Europe reached 240,891 units in March, the second-highest month on record.

- Tesla led March sales but dropped to second in Q1, as VW soared with a 157% increase.

- The launch of the updated Model Y Juniper failed to reverse Tesla’s downward trend.

The EV market in Europe is on a strong upward trajectory, with March 2025 marking the second-best month on record for registrations, contributing to the strongest quarter ever for battery electric vehicles (BEVs). Despite this impressive growth, however, Tesla’s updated Model Y “Juniper” couldn’t quite reverse the brand’s ongoing sales decline.

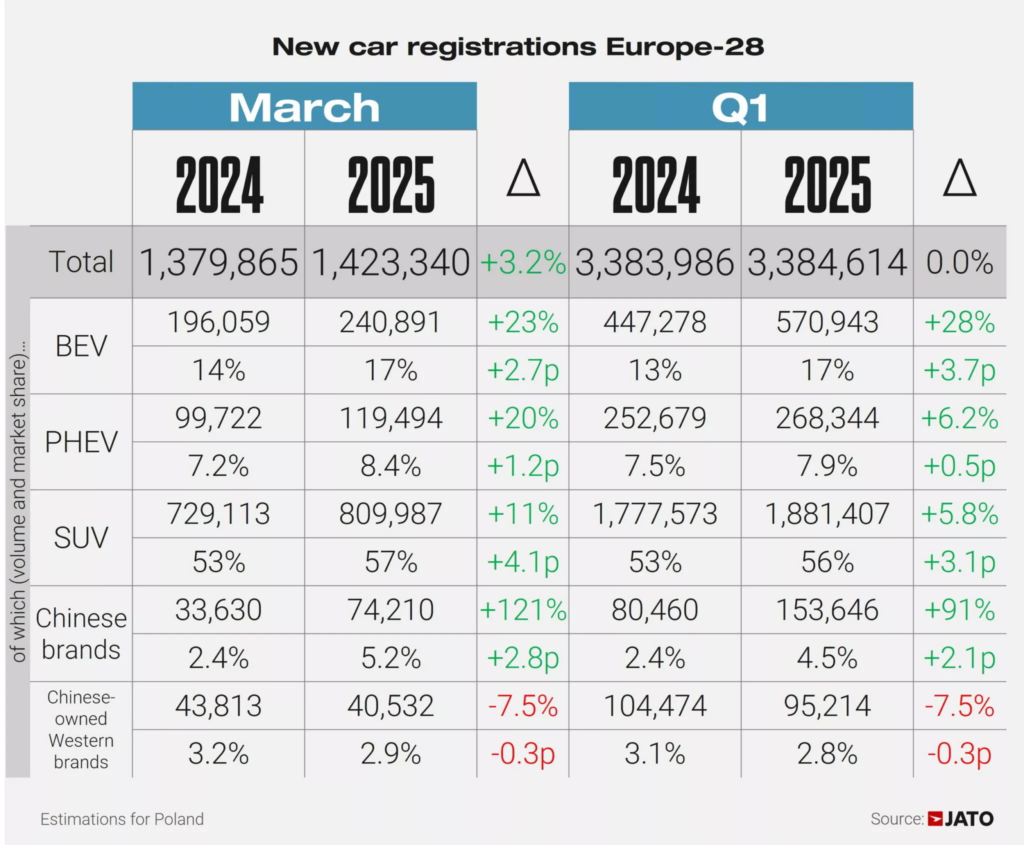

In March, BEV sales across Europe reached 240,891 units, marking a 23% year-over-year increase and capturing an impressive 17% market share, roughly one in five new vehicles sold. While this figure just misses the all-time high of 275,108 units set in December 2022, it still played a key role in making Q1 2025 the strongest quarter for BEV sales in European history.

More: Tesla Delays Cheaper Smaller Model Y, Plans Stripped-Down Model 3

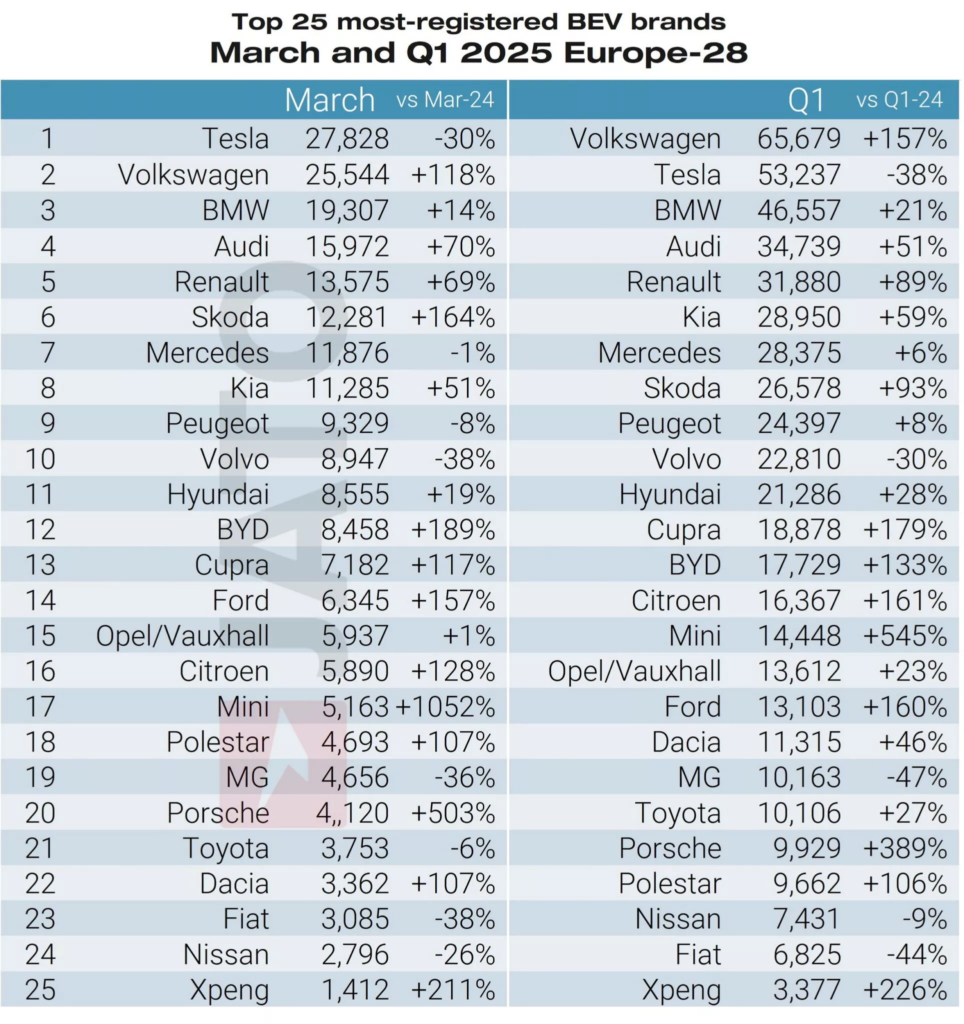

According to data from JATO Dynamics, which includes 28 European markets, Tesla was the top-selling BEV brand in March 2025, despite experiencing a 30% drop compared to March 2024. However, this was an improvement compared to the sharper declines seen in January (-47%) and February (-44%), which, for Tesla, is at least a small win.

VW Finally Beats Tesla

This downward trend left Tesla in second place for BEV sales in Q1 2025, with 53,237 registrations (-38%), trailing behind VW, which saw a remarkable 157% increase with 65,679 units sold. Even BMW is now closing in on Tesla, recording a 21% increase over the same quarter last year with 46,557 sales in Q1 2025. The top 5 spots are rounded out by Audi, with 34,739 units sold (an impressive 51% growth), and Renault, which posted 31,880 deliveries, an even more impressive 89% increase.

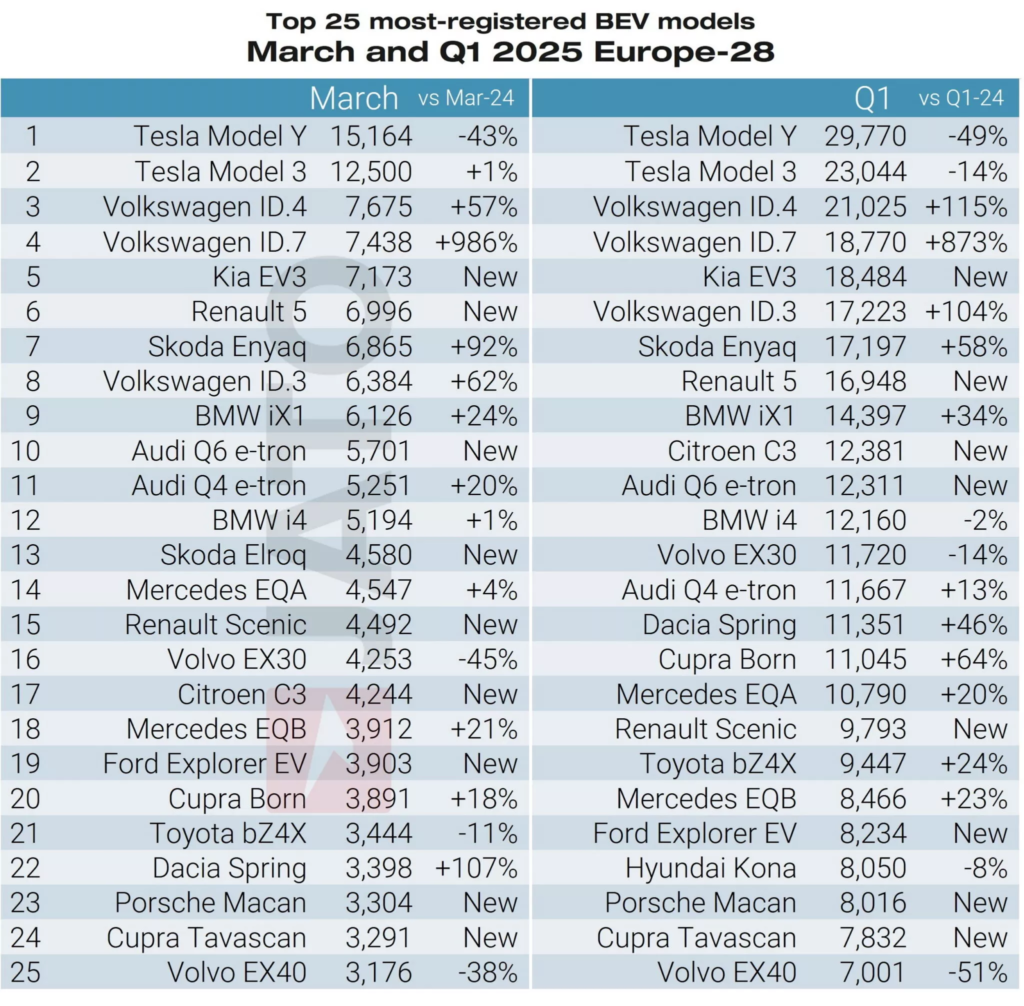

When it comes to individual electric models, Tesla’s Model Y and Model 3 dominated the top spots in Europe for Q1 2025, with 29,770 (-49%) and 23,044 (-14%) registrations, respectively. Interestingly, the much-hyped launch of the heavily updated Model Y Juniper didn’t quite deliver the expected sales spike. In its first full month of sales in March 2025, it recorded 15,164 registrations, a 43% drop compared to the previous year.

More: Tesla’s 15% Sales Crash In California Could Signal A Bigger EV Crisis

VW made a strong showing, with three of its models in the BEV top 10 chart for Q1 2025: the ID.4 (3rd), ID.7 (4th), and ID.3 (6th). Other noteworthy entries included the Kia EV3 (5th), the Renault 5 E-Tech (8th), and the Citroen e-C3 (10th), all of which are new additions to the list.

In the U.S. market, EV sales reached 296,227 units (+11.4%) in Q1 2025, with Tesla commanding a significant 43.5% share (128,100 units), despite a slight -8.6% dip in sales compared to the same period last year.

Overall Sales Show Modest Growth in Europe

Back in Europe, regardless of powertrain type, a total of 1,423,340 vehicles were registered in March 2025, marking a 3.2% increase. This brought the Q1 total to 3,383,986 units, a nearly flat -0.02% change. The Peugeot 208 topped the sales charts in March, while the Dacia Sandero held onto its lead in the Q1 rankings.

In terms of sales declines, Tesla (-38%) wasn’t the only brand facing challenges. Other notable drops in Q1 included Maserati (-39%), Mitsubishi (-43%), Smart (-65%), Lancia (-73%), Abarth (-75%), and Jaguar (-82%).